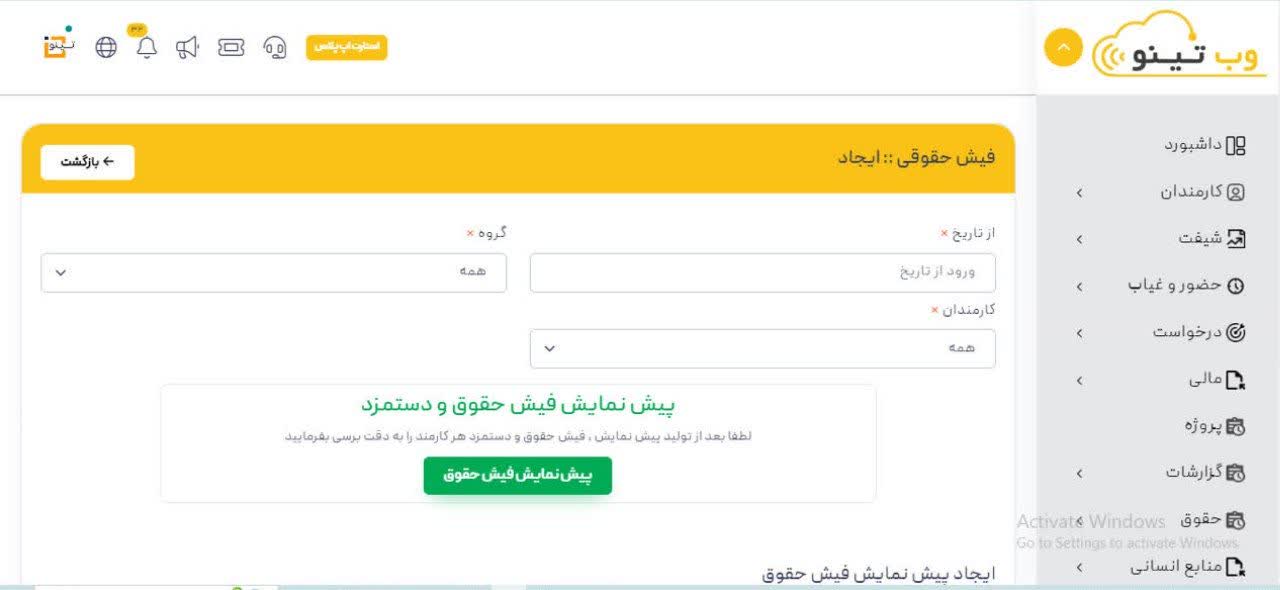

salary

salary

Employee salaries

Pay slip

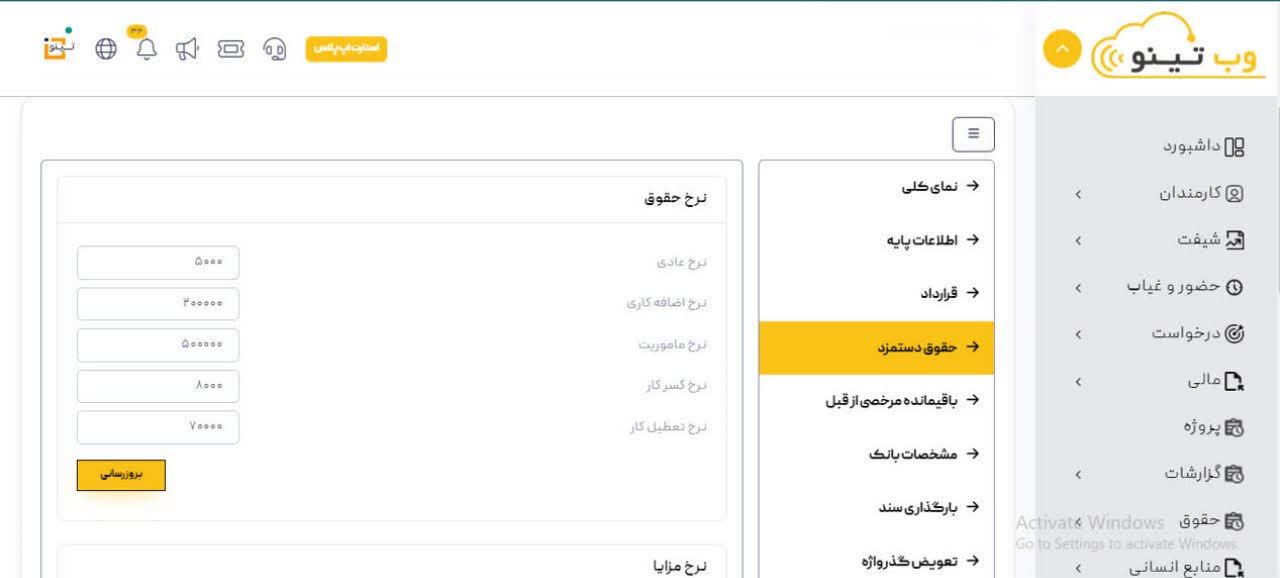

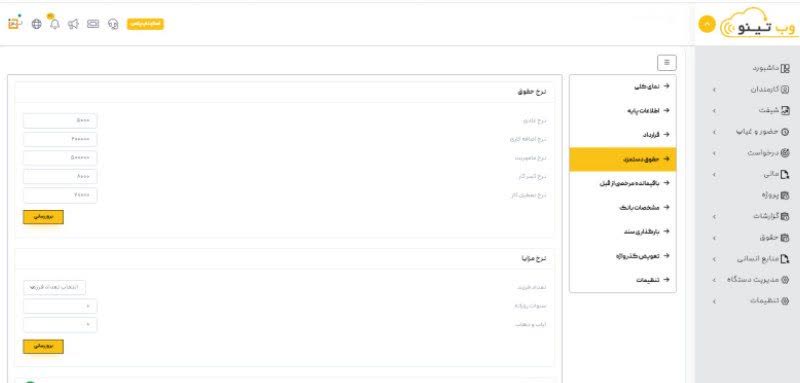

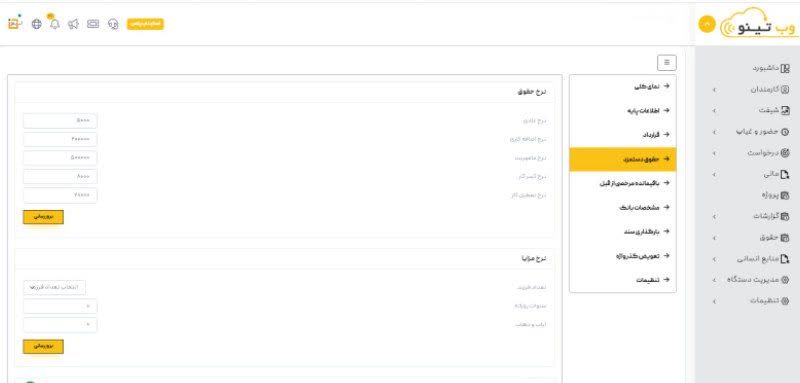

By entering basic values such as base salary, overtime, tax deductions, etc., create a complete payslip and post it in the user account for users to view. This helps users easily view their salary details and fix any issues if needed. As a reliable and transparent data, this payslip provides important financial information to employees and can be used as an effective tool for financial management and personal financial planning. In addition, this feature also helps employers improve the employee payroll management process and ensure that all calculations are done correctly. With this approach, creating a complete and updated payslip is an effective way to facilitate the recruitment and retention of team members and can greatly help increase employee satisfaction and performance.

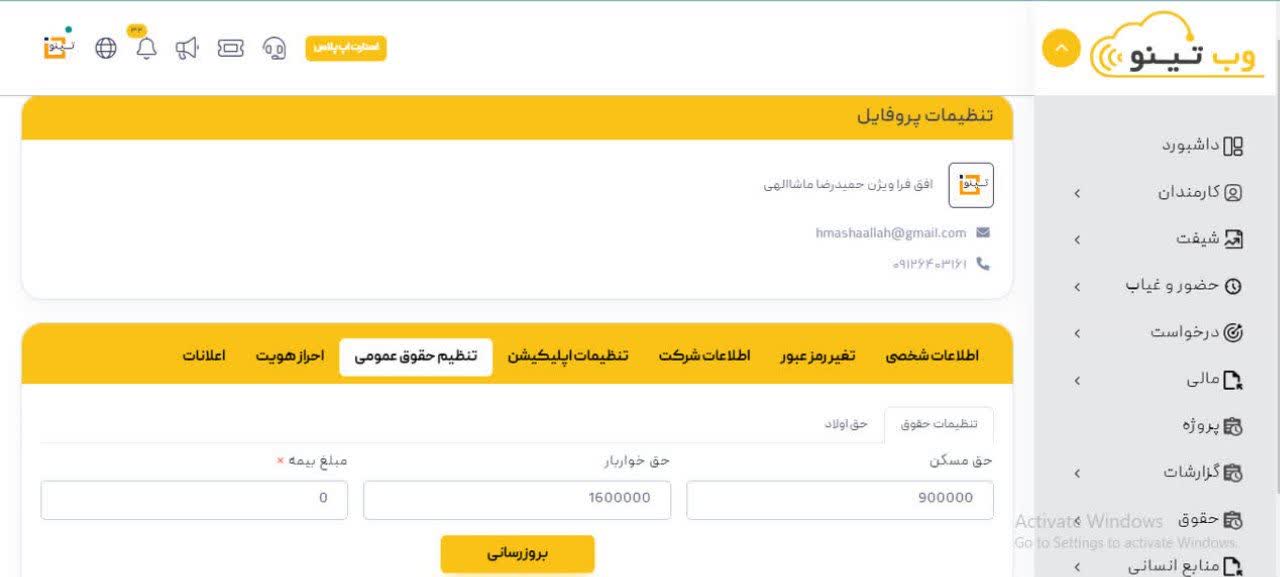

Salary calculation involves adding bonuses and overtime to the basic salary of an employee. Deductions like taxes and insurance are subtracted from the total salary. Non-monetary benefits and time-related aspects are also taken into account.

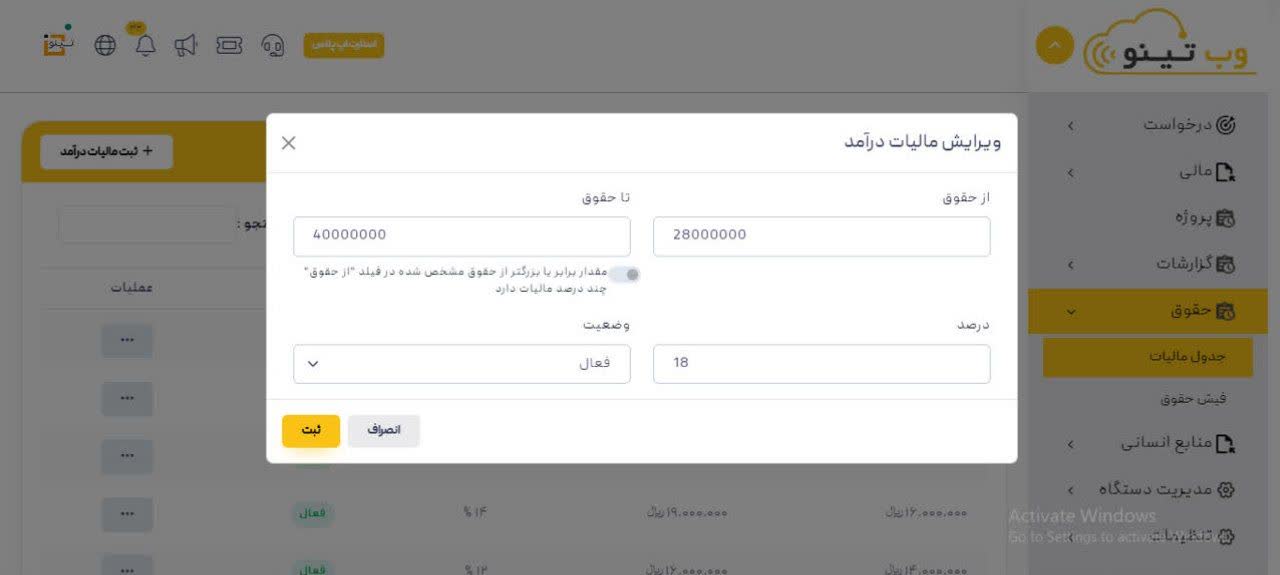

The table illustrates varying tax payments associated with income increments. Tax rates can either be progressive (increasing with income) or fixed (uniform across income levels).

Employee insurance premium deduction refers to the amount that is deducted from the employee's salary. This amount is usually determined in proportion to the employee's income and varies depending on the relevant laws and the employer's policies.

The payroll deduction covers employee pay reductions for taxes, insurance, benefits, and contributions, including government tax, insurance, loan installments, and charity deductions.

Extra pay on top of basic salary, including overtime, bonuses, performance and productivity bonuses, non-cash benefits like amusement tickets or medical assistance, and other additional perks.

Why employee payslip

The versatility of Tnoo software

One of the features and competitive advantages of Tino software is the use of various modules. In fact, by purchasing Tnoo you no longer need many modules. is not

Issuance of receipts based on attendance

With just a few simple clicks, after receiving the attendance and absence information of the employees, you can issue the salary slip of each employee individually or in a group.

Inclusion of various policies in Tnoo

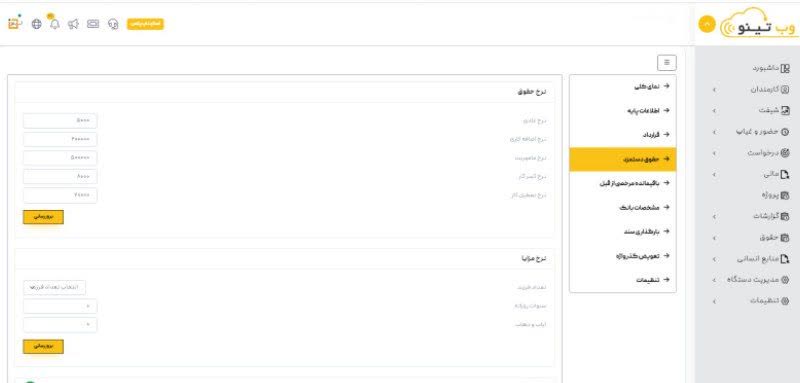

You can implement any law and policy you have for business management and salary conditions, including normal work rates, overtime, work holidays... in Tino.

One of the features and competitive advantages of Tino software is the use of various modules. In fact, by purchasing Tino, you no longer need many modules. is not

read more

If needed, you can put the salary slips of the employees in the employee panel so that they can perform personal checks based on their attendance and monthly performance.

read more

This transparency, which is due to the ability to insert receipts and details in the employee panel of the software, will convey a sense of security to the human resources of your collection.

read more

Tino's payroll slip module is very complete and you have no limits for the rules and calculation rules that suit your business for employee salaries.

read more

Example of employee payslip